Coach Mitch’s REFLECTIONS™

Part 1 of 4

Coach Mitch’s Editorial Comment

The sections of the report I comment about are provided in full and within context. To read the entire 52 page report goto: FBI: licensed brokers/bankers/lawyers/appraisers/loan officers do lots of mortgage fraud

Targeting mortgage fraud

The idea behind the study is excellent: to determine who perpetrated mortgage fraud so as to prosecute the culprits and stop it from continuing.

Sadly, the fix was in and the finger of blame is fixed on those carrying out policy instead of blaming the makers of the policy. In finance, just as in politics, nothing happens unless the bosses want it to happen. The real culprits of the mortgage crises, the CEO’s of the banks and Wall Street, are entirely ignored. Instead, the finger of blame is pointed at underlings. Such are the perks of power. RHIP. (Rank Has It’s Privileges)

Federal Bureau of Investigation

2010 Mortgage Fraud Report

The purpose of this study is to provide insight into the breadth and depth of mortgage fraud crimes perpetrated against the United States and its citizens during 2010.

Mortgage Fraud

Mortgage fraud is a material misstatement, misrepresentation, or omission relied on by an underwriter or lender to fund, purchase, or insure a loan. This type of fraud is usually defined as loan origination fraud. Mortgage fraud also includes schemes targeting consumers, such as foreclosure rescue, short sale, and loan modification.

Key Findings

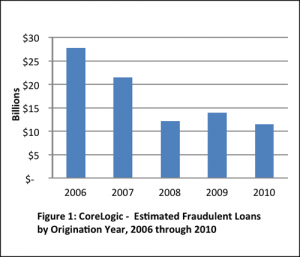

* Mortgage fraud continued at elevated levels in 2010,…fraud schemes are particularly resilient, and they readily adapt to changes in lending practices.

* Mortgage fraud perpetrators include licensed/registered and non-licensed/registered mortgage brokers, lenders, appraisers, underwriters, accountants, real estate agents, settlement attorneys, land developers, investors, builders, bank account representatives, and trust account representatives.

Coach Mitch:

Missing from the list of perpetrators are the policy makers. As I read the report I was interested to see that, IMHO, the FBI has some suppositions correct, but they fail to point out the big reasons for the banking crises – bank CEO and Wall Street mortgage fraud. Why am I not surprised that CEO’s and Wall Street types are not targets of this fraud investigation.

You will see that the above mentioned fraud perpetrators are all licensed professions. The government’s number one crime prevention tool is to demand that everyone is licensed.

Since it is obvious that licensing does not stop a criminal mind from doing crime, why have licensing? Licensing is one of government’s main tools to control the workforce, that’s why.

* Prevalent mortgage fraud schemes reported by law enforcement and industry in FY 2010 included loan origination, foreclosure rescue, real estate investment, equity skimming, short sale, illegal property flipping, title/escrow/settlement, commercial loan, and builder bailout schemes. Home equity line of credit (HELOC), reverse mortgage fraud, and fraud involving loan modifications are still a concern for law enforcement and industry.

Coach Mitch:

The above schemes are all approved programs. When reading the report, even an innocent misstatement is labeled “mortgage fraud.”

For a loan originator to do a loan successfully, significant financial information is needed and often the details are manipulated to show the applicant in the most favorable light. This is being labeled as mortgage fraud.

There are limits however. Banks want to know about an applicant’s assets, which can be hyped, but it is not smart to list $100,000 of imaginary stock and then state that money is not available for a down payment. The bank will be suspect were the applicant to not want to sell some stock to raise the down payment. Besides, I always got a statement from the brokerage house showing the value of the asset, which also proved that the asset existed.

* A continued decrease in loan originations…high levels of unemployment and housing inventory, lower housing prices, and an increase in defaults and foreclosures dominated the housing market in 2010… 2.9 million foreclosures in 2010, representing a …23 percent increase since 2008.

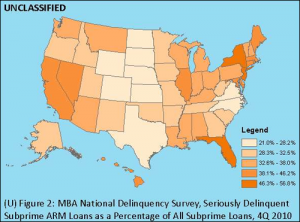

* Analysis…indicates the top states for…mortgage fraud activity during 2010 were California, Florida, New York, Illinois, Nevada, Arizona, Michigan, Texas, Georgia, Maryland, and New Jersey.

FBI

FBI mortgage fraud pending investigations totaled 3,129 in FY 2010, a 12 percent increase from FY 2009 and a 90 percent increase from FY 2008. According to FBI data, 71 percent (2,222) of all pending FBI mortgage fraud investigations during FY 2010 (3,129) involved dollar losses totaling more than $1 million.

In FY 2010, HUD-OIG had 765 pending single-family residential loan investigations, a 29% increase from the 591 pending during FY 2009. This also represented a 70% increase from the 451 pending during FY 2008. Fraud schemes reported by HUD in ongoing investigations include flopping, reverse mortgages, builder bailout schemes, short sales, and robo-signing.

Coach Mitch:

Imagine, there are 2.9 million foreclosures and the FBI touts 765 residential loan investigations, and that is a whopping 29% increase over 2009. The FBI is really on the job! [sarcastic] Not only are the major bank CEO’s not being held accountable, the licensed financial professionals are also not being held accountable. Our government at non-work. [sarcastic]

The only way to beat evil is to overcome it. Fight fire with a conflagration. Fight the banks by making your own money, earning more that is.

See Coach Mitch’s “Ridiculously Simple System…” ™ for details.

Gird your loins – the battles await,

Leave a Reply